Are you confused about what is covered under your Medicare Part D Prescription Drug Plan? So many of my clients are unclear about the guidelines around enrollment, why they need to enroll, and what to do if you’re not on any medications. Before we fully dive in, let’s start with the basics.

What is a Medicare Part D Prescription Drug Plan?

Sometimes Medicare Part D Plans are referred to as an ‘Rx’ plan. The Medicare Part D Prescription Drug Plan is a federal program administered through private insurance companies that offer retail prescription drug coverage to Medicare beneficiaries. If you are on Original Medicare, the Medicare Part D Prescription Drug Plan is a standalone policy you need to obtain.

If you are on a Medicare Advantage Plan, your plan may have the Medicare Part D Prescription Drug plan included. If this is the case the Medicare Advantage plan would be called MAPD, Medicare Advantage Prescription Drug plan. As a standalone policy, the Medicare Part D Prescription Drug plans are customized to your medical needs which lowers your individual cost.

Do I NEED to Enroll in Medicare Part D Prescription Drug Plan? YES, YOU DO.

Almost everyone asks if they need to enroll in a Medicare Part D Prescription Drug Plan. This is followed up with “what if I am not on any medications?” The answer to both questions is YES! Whether you are taking medications or not, it is critically important you enroll in a Medicare Part D Prescription Drug Plan. Why? If you do not enroll in a Medicare Part D Prescription Drug Plan, Medicare penalizes you for not having creditable drug coverage.

The penalty amount is typically 1% of the Medicare Part D Prescription Drug Plan national base premium for that year. The penalty is for each full, uncovered month, you do not have a Medicare Part D Plan (or creditable coverage). Medicare, not the drug company, determines your penalty. The monthly penalty is rounded to the nearest $0.10 and added to your monthly plan premium for the entirety of your time on Medicare. I am going to repeat that, the penalty is added to the monthly Medicare Part D Prescription Drug Plan premium for the life of your coverage on Medicare. So in short, don’t miss enrolling in this program!

Medicare Part D Prescription Drug Plan Penalties

In general, if you have had a break in creditable prescription drug coverage for 63 days or more after the end of your initial enrollment period for Medicare, you will face a Medicare Part D late enrollment penalty.

What is the Best Medicare Part D Prescription Drug Plan?

I field a lot of questions about how to determine which Medicare Part D Prescription Drug Plan is best. There are multiple options available, which is a nice way for you to customize your plans based on your specific medication needs. This customization will lower your individual costs. Each Medicare Part D Prescription Drug Plan provider (which are private insurance companies) has a particular formulary. What is a formulary? A formulary is a list of drugs that the insurance plan covers.

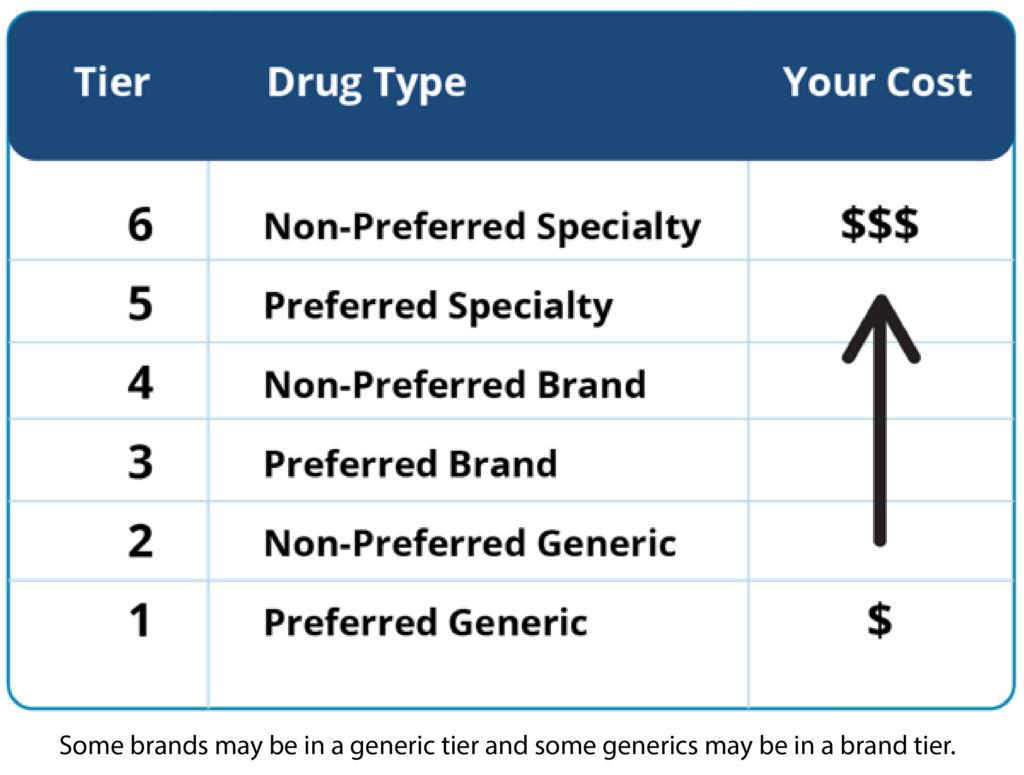

The formulary is divided into levels, called tiers, which are based on the cost of the medicine. The amount you pay each time you fill a prescription depends on the tier. Generally, the lower the tier, the lower the copay. You can find out what your cost will be for each prescription by adding your drugs into the Medicare Part D Prescription Drug finder on Medicare.gov , or working with a licensed agent. This will help you determine which plans have the lowest out-of-pocket costs for your specific medications.

Bottom line, you need to have one of these plans. Your cost will be determined by the individual medications you take, and what plans cover those specific drugs.

How are Costs of Medications on a Medicare Part D Prescription Drug Plan Determined?

Every medication you take will fall into a tier established by an insurance company. Different insurance companies will have different tier systems, and the cost of your drug may vary by insurance carrier. Most insurance companies have five tiers, some six. Tiers may be structured like this:

The Pharmacy You Chose Affects the Cost You Pay!

Your insurance company isn’t the only thing impacting your costs. When choosing your drug plan you have options as to which pharmacies to use. The choice of pharmacy is an important piece of the puzzle to which you need to pay attention. You want to look at the ‘preferred’ pharmacy on the plans.

The preferred pharmacy is where you save the most amount of money. Take your time and see what cost savings you can get from just changing your pharmacy.

It sounds like there’s a lot to evaluate here, right? You don’t have to navigate all these pieces on your own. Let Medicare Dana do the work for you, and help you find the most appropriate plan for your needs at the lowest cost.

Remember, EVEN IF you are not taking any medications, you do need a Medicare Part D Prescription Drug Plan, or you will be penalized. You should choose one as a placeholder with the lowest premium. If you do not enroll you will be charged a Medicare Part D Late Enrollment Penalty.

What Insurance Company Should I Choose?

A common misconception is that you should enroll with the same insurance company for your Medicare Part D Prescription Drug Plan as your Medicare supplement plan. This is not the case. Medicare supplement insurance coverage is separate from Medicare Part D Prescription Drug Plan coverage. There is no added benefit to you using the same carrier.

If you are shopping the full market for your Plan D options that have the overall best coverage and price for your needs (which you should be!), your plan benefits will most likely be administered by two separate insurance carriers.

How to Save Money

Now, it is important to know that the Medicare Part D Prescription Drug Plans change their formularies each year. This affects the costs and tiers of the medications covered on the plans. Changes can be made to your Medicare Part D Prescription Drug Plan once a year during the Medicare Annual Election Period (AEP).

It is very important you re-evaluate your drug plan annually during AEP, to confirm you have the best cost savings plan for your needs. Each year, AEP is October 15-December 7. If you do not review your medication plans, it could be a costly mistake!

If you do nothing, your Medicare Part D Prescription Drug Plans will auto-renew for the next year. While this may seem like the easy option, the problem is that formularies may change in your plan which can increase your co-pays or premiums.

To save the most money, each year you will need to check the medications you are taking against the drug plans available and find the best fit.

How Does Veterans Affairs (VA) Benefits Work with Medicare Part D Prescription Drug Plan?

If you have Veterans Affairs (VA) benefits, you are considered by Medicare to have ’creditable drug coverage.’ This means if you are enrolled in VA drug coverage, you can delay enrollment in your Medicare Part D Prescription Drug Plans. If you decide to join a Medicare Part D Prescription Drug Plan later, you can do so without incurring a late enrollment penalty (LEP).

Can you have VA Drug Coverage and Medicare Part D Prescription Drug Plan?

If you have Veterans Administration (VA) drug coverage, you can also join a Medicare Part D Prescription Drug Plan or Medicare Advantage plan that includes drug coverage (MAPD). Together, these two types of coverage might provide the broadest and most economical prescription drug coverage.

If you are considering enrolling in VA drug coverage and Medicare Part D, it is important you know that these two do not work together. VA benefits will only pay at VA pharmacies and facilities, and Medicare Part D will only pay at pharmacies in your Part D plan’s network.

While you can have both VA drug coverage and Medicare Part D coverage, you will not be able to use your VA benefits together with your Medicare Part D benefits to pay for the same prescription.

To help you obtain the most appropriate Medicare Plan for your needs and answer all your Medicare questions, contact Medicare Dana: 512-666-7785, fill out a contact form, or leave a comment below. Looking forward to hearing from you!