Are You Turning 65 And Confused On What To Choose For Your Medicare Coverage?

Let Us Help Point You In The Right Direction!

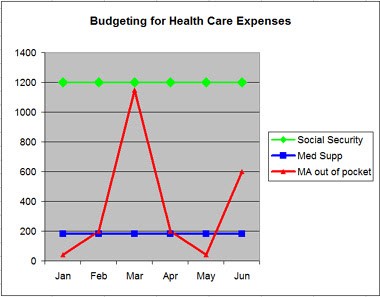

Most people are on a fixed income when they retire.

As you near your 65th birthday, you may notice an uptick in phone calls, direct mailers, and unsolicited knocks on your door from insurance companies trying to sell you a Medicare Plan. It can be overwhelming and confusing to make sense of all the information. There are two main ways to enroll in Medicare; Original Medicare with a Supplement plan or Medicare Advantage. The two Medicare programs are very different.

So what is better? A MediGap (supplement) plan? Or is a Medicare "Advantage" plan the best way to go?

Typically, our clients do not like SURPRISES with their health care or financial security, so they tend to choose Original Medicare with a Supplement Plan.

With a Medicare Supplement plan, you have consistent monthly premiums each month with no surprise expenses.

This works well for someone on a fixed income.

With a Medicare Advantage Plan, the out of pocket expense can be quite large and you could have BIG surprises when you need medical treatment.

Avoid the spikes in cost (red line) that are possible with a Medicare Advantage plan, such as an $1,800 bill for one hospital stay.

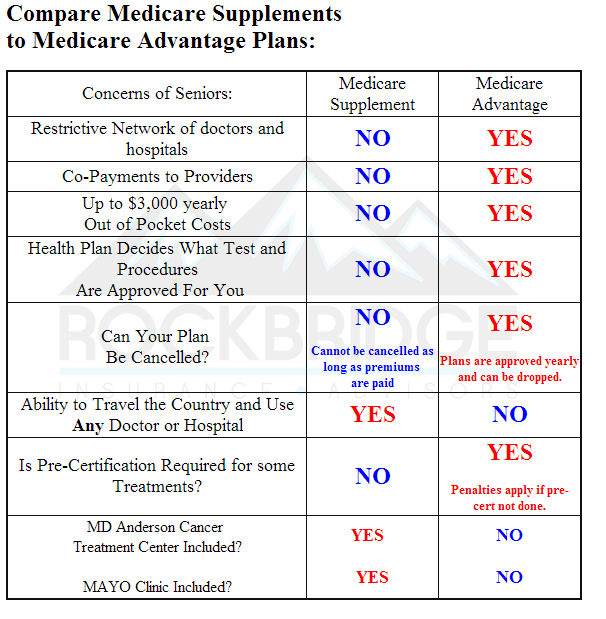

Also consider these critical differences in the two types of plans:

Schedule A Consultation

Call us at (512) 666-7785 or send an email by filling out the form below.

Our services are 100% FREE of charge.