Healthcare coverage in the United States is expensive. In some form or fashion, almost everyone has felt the impact of the high price tag on healthcare. Be it a surprise medical bill, an insurance policy denying a claim, or paying monthly premiums to what we think is full coverage only to discover that the fine print says otherwise.

We all have experienced frustration with our healthcare policies but on the other side of the coin we’re also grateful for the coverage when we need it.

Bold statement here, but I would argue that your medical premiums are the single most important bill you pay. The older you get, the more that rings true.

Financial Planning & Healthcare Go Hand in Hand

For many people financial planning starts at a young age, with the goal being that your money out lives you rather than the opposite. You work until retirement to secure and protect your future. Quality medical coverage is critical to your future wellbeing, both from a medical perspective and a financial one.

Without proper and quality medical coverage, your entire retirement fund could be spent on a single medical expense. It might sound crazy, but it’s true.

The United States has one of the highest costs of healthcare in the world. As costs continue to rise for other necessities like fuel, food, and housing, we can likely count on our healthcare costs continuing to rise too.

Plan Ahead for Rising Healthcare Costs

Knowing healthcare costs are rising, it’s more important now than ever to make sure you’re doing everything you can to educate yourself on your options, keep your costs as low as possible without sacrificing vital services and medications you need, and read the fine print!

Leading up to age 65, the only options for medical coverage have been group or individual insurance, all provided for by private insurance companies that are either an HMO or PPO. When you enroll in Medicare, you have three options:

- Original Medicare on its own

- Original Medicare with a supplement plan

- Medicare Advantage

The programs are vastly different in terms of coverage, benefits, and costs. One is an HMO/PPO plan, similar to what most are used to, and the others have no networks at all with nationwide coverage. As you retire:

- Be sure you’re not paying more than necessary

- Be sure you're understanding all your options and what you are entitled

- Be sure you're reading the fine print

If you’re contemplating retirement in the next few months or years, you might be wondering about the costs of your healthcare coverage. And you should be! Start the conversations early, plan out the costs, learn all your options and important timelines that may affect start dates.

Planning for Healthcare Costs

Some questions you may be asking yourself are: “Is Medicare more expensive than private insurance? What do the costs really look like, for things like premium, deductibles, and max out of pocket costs? How do I get started?”

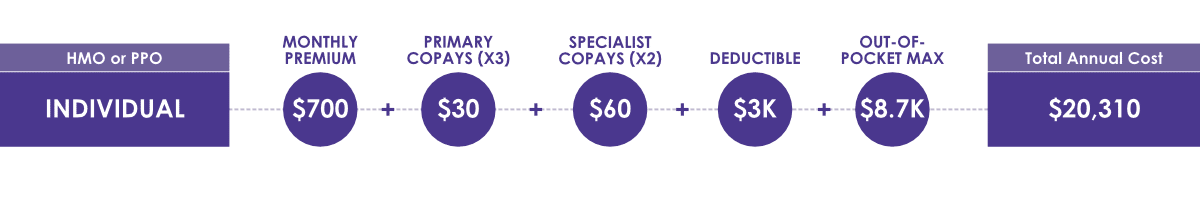

To aid in sorting this out for you, we created a visual map to help you see the healthcare options you have and the breakdown of potential costs. It may surprise you that in some cases, Medicare is far less expensive than what you have been paying with your private insurance and in other cases, Medicare is far more expensive.

With an average cost of $12,500 per person for healthcare in the United States, do all you can to plan early and educate yourself on steps you can take to find the most cost-effective, appropriate healthcare option for you. You may be surprised what you learn about the Medicare programs and costs. And we don’t want you to be surprised!

This graphic leads you down different roads for obtaining healthcare. Healthcare plans vary greatly so the purpose of this graphic is to showcase the range of options and associated estimated costs.

Private Individual Insurance Costs

One track takes you on a journey of individual insurance – via an HMO or PPO. You will have a monthly premium (ranging $100 to $2000) in addition to copays for doctor visits, in-network, and out-of-network deductibles, and a separate out of pocket maximum, set per plan, in order for you to meet the requirements to receive full coverage from your plan.

So that’s roughly $1,200 to $24,000 per year just in premiums alone, not taking into consideration copays and deductibles. Copays are usually a set amount for each doctor’s visit, and an increased amount for specialists, Urgent Care, and Emergency Room visits.

Let’s look more closely at the costs:

- Say your premium is $700 a month

- Regular doctor visit copays are $30, and you visit the doctor three times in a year for an additional $90

- Specialist doctor visits are $60, and you visit a specialist doctor twice a year. That’s an additional $120

- Your deductible could be anywhere from $0 to $8,700, so for this estimate let’s assume your deductible is $3,000

- Your out-of-pocket maximum, for this example, is $8,700

So you may have to pay annually at least $20,310 with the out-of-pocket max.

Group Insurance from an Employer Costs

Another track takes you on a journey of Group insurance - typically under group plans the employer is assisting by paying a portion of the monthly premium. For this option, we will assume all the same of the above, except that the premium would typically be substantially lower depending on what portion your company contributes.

Let’s look more closely at the costs:

- Say your premium is $350 a month (your employer paying for half)

- Regular doctor visit copays are $30, and you visit the doctor three times in a year for an additional $90

- Specialist doctor visits are $60, and you visit a specialist doctor twice a year for an additional $120

- Your deductible could be anywhere from $0 to $8,700, so for this estimate let’s assume your deductible is $3,000

- Your out-of-pocket maximum, for this example, is $8,700

This would bring your total annual costs to $16,1100 with the out-of-pocket max.

Medicare Costs

There are three options for Medicare:

- Original Medicare

- Original Medicare with a Supplement

- Medicare Advantage (Part C)

Original Medicare without a supplement plan is not talked about often because it leaves you far too exposed to financial risk (explained a little further below) and is not recommended. Each option has its own costs, benefits, and coverages.

Original Medicare Costs

When you enroll in Medicare Parts A and B only, you are enrolled in what’s called Original Medicare (some also refer to this as Traditional Medicare).

There are premiums for Medicare A and B. Typically Part A is $0 a month and the Part B 2022 standard premium is $170.10 a month. Higher wage earners can have a higher premium.

Original Medicare alone has many gaps in coverage, some being a $1,556 hospital deductible, copays for hospital days over 60 days, and you are responsible for 20% of medical bills with NO cap, amongst other gaps.

The financial risk of obtaining Original Medicare without a supplement or Medicare Advantage plan is astronomical and not recommended.

Original Medicare with either a Supplement or Medicare Advantage Plan

The two options to consider are Original Medicare with a Supplement plan or a Medicare Advantage plan. Regardless of which plan you choose; you must pay the part A and B premiums.

So as a reminder, typically the Part A premium is $0 a month and the Part B premium is $170.10 a month. Higher wage earners can have a higher premium.

Original Medicare is not an HMO or PPO network. There are no networks, meaning no set of providers you must stay within and no restrictions on geographical area.

You can go to any doctor or facility nationwide that accepts Original Medicare (96% in the United States) and there are no prior authorizations or referrals needed.

This also means no denials for necessary treatments. You are in control of your healthcare under Original Medicare with a supplement plan.

Original Medicare with Supplement Costs

Supplement plans are designed to work alongside Original Medicare to cover the gaps in costs of Original Medicare alone (reminder- some being a $1,556 hospital deductible, copays for hospital days over 60 days, and being responsible for 20% of medical bills with no cap, amongst other gaps).

A supplement plan has the same rules and guidelines as Original Medicare: nationwide coverage, no referrals, no authorization, no denials.

A supplement plan has an additional monthly premium typically ranging from $30 - $350 a month. The most popular Supplement plans have $0 copay and a $233 annual deductible (in 2022).

No in network or out of network deductible because there is no network. Your maximum out of pocket costs is the $233 annual deductible. Once that is met, the plan kicks in - in full - and you pay nothing more than your monthly premium. No surprises!

Let’s look more closely at the costs:

- Say your Part A premium is $0

- Say your Part B premium is $170.10

- Supplement Plan premium is $100/month

- Annual deductible $233

This would bring your total annual costs to $3,474.20, inclusive of the annual deductible.

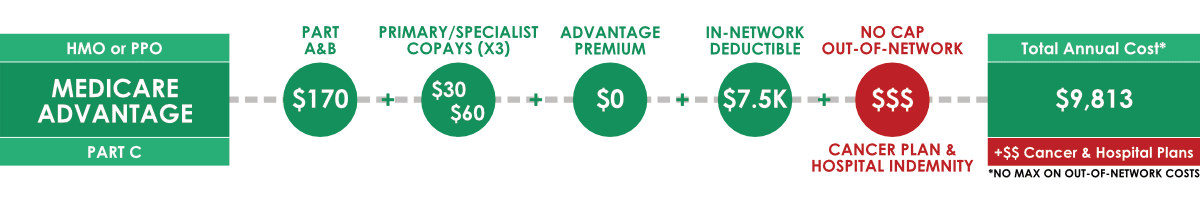

Medicare Advantage Plan Costs (Part C)

You can choose to “opt out” of Original Medicare and purchase a Medicare Advantage (MA) Plan, also known as Medicare Part C. These are privately run insurance programs that have a contract with the federal government.

If enrolled in a Medicare Advantage plan, you are no longer considered to be enrolled in Original Medicare. Someone enrolled in a Medicare Advantage plan no longer falls under the Original Medicare umbrella or safeguards. They give up their rights to the private insurance company who controls the insurance policy.

Medicare Advantage plans are all HMO or PPO plans, and mirror that of the group or individual plans detailed above. That means, along with a monthly premium, these plans have a copay for each doctor’s visit, Urgent Care, Emergency Room, in-network, and out-of-network deductibles, and a separate out of pocket maximum that needs to be paid out in order for you to meet the requirements, per policy, for full coverage.

These plans have a restrictive network of providers, prior authorizations and referrals are needed, and denials for treatment or procedures occur.

Each Medicare Advantage plan has its own set of rules (that fine print), costs, coverage, and benefits. Monthly premiums are typically $0-$200 and you will have a copay along with an in-network deductible of up to $7,550 in 2022 and NO cap on out-of-network deductible.

Let’s look more closely at the costs:

- Say your Part A premium is $0

- Say your Part B premium is $170.10

- Medicare Advantage plan premium is $0

- Regular doctor visit copays are $30, and you visit the doctor three times in a year for an additional $90

- Specialist doctor visits are $60, and you visit a specialist doctor twice a year. That’s an additional $120

- Your in-network deductible is $7,550

Assuming you stay within your network, and don’t get denied needed medical treatments, this would bring your total annual costs to $9,813.20.

If your doctor is out-of-network, there is NO maximum you can reach.

Medicare Advantage plans do not have the same coverage as Original Medicare and a supplement plan with two of the biggest gaps being inpatient hospitalization and cancer treatments/medications.

If purchasing a Medicare Advantage plan you should also purchase Hospital Indemnity Insurance and a Cancer plan for full coverage.

Medicare Advantage plans may impose additional out-of-pocket costs if you have an accident, long-term illness, or other hospital stay. You may face large copays for your first few days in the hospital and your deductibles, copayments, and coinsurance can add up quickly.

Your maximum out-of-pocket (MOOP) expenses on a Medicare Advantage plan can be as high as $11,300 for a hospital stay.

Hospital indemnity insurance pays you a fixed amount for each day you’re hospitalized to help offset your MOOP.

Cancer is not covered well on most Medicare Advantage plans. When chemotherapy or radiation are administered, you are typically responsible for 20%.

Depending on the drug and type of cancer it treats, the average monthly cost of chemo drugs can range from $1,000 to $12,000, per session. 20% is $200-$2,400, per session!

There are some oral medications for chemotherapy that can be well over $5,000 a month, which would cause you additional money out of pocket.

Enrolling in a cancer plan pays you cash benefits upon a cancer diagnosis.

HMO vs. PPO?

HMO stands for Health Maintenance Organization and the coverage restricts patients to a particular group of physicians called a network. With an HMO you must have referrals from a predetermined general physician and obtain preauthorization before any procedures.

PPO is short for Preferred Provider Organization and this coverage allows patients to choose any physician they wish, either inside or outside of their network.

The Conclusion? You Don’t Know Until You Have the Info!

Your healthcare is an important part of your quality of life. Just like buying a house or changing jobs, the information is critical to making a good decision. Your individual circumstances and needs will determine the most cost-effective choice.

It’s impossible to say which journey to healthcare coverage is the right one for you without first understanding all the options available and analyzing their benefits as it relates to your situation. Download our Medicare Costs vs. Private Insurance PDF for a visual breakout of the differences in costs between plans.

And to add even more to the already full “Medicare Plate” so to speak, not everyone has to enroll in Medicare when they turn 65 which places even a greater importance on making an informed decision.

Don’t wait to ask questions about your future and current healthcare needs. It’s always a great time to find out if you could benefit from switching Medicare plans. It’s too important to “set it and forget it.”

Let JBird Insurance help you make better decisions for your health and your wallet.